Over the last few days, I’ve had the chance to read through the 188-page S-1 filing for Oak Street Health.

To save you the pain (pleasure?), I wanted to share some of my learnings. Let’s go on this journey together…

Intro to Oak Street Health

Oak Street Health is a provider of primary care for seniors that was founded in 2012 and IPO’ed earlier this month. They’re headquartered in Chicago, and have seen rapid expansion since then to 7 states.

Oak Street is interesting because they emphasize four healthcare trends as key strategic differentiators in their prospectus:

Our patient focus. We are focused on the Medicare-eligible population, which generally has consistent, clinically cohesive needs and which we believe represents the greatest potential for cost savings, while still benefiting patient health outcomes, in our current healthcare system.

Our technology-enabled model. We leverage technology that compiles and analyzes comprehensive patient data and provides actionable health insights through applications that are embedded in care delivery workflows, including at the point of patient-provider interaction.

Our integrated approach to care delivery. We integrate a personalized approach to primary care, proactive management of our patients’ health needs and expanded preventive services to keep our patient population healthy, reducing the number of hospitalizations and other expensive and unnecessary utilization of the healthcare system. As such, we focus on delivering what we believe to be the right care in the right setting, encouraging our patients to visit us in our centers, while also offering robust virtual and digital engagement options.

Our value-based relationships. Our value-based capitation contracts reward us for providing high-quality care rather than driving a high volume of services.

While almost everyone in healthcare agrees in principle with these strategies and pays lip service, the actual pace of implementation in the market has been painfully slow in my opinion.

However, it seems like Oak Street Health is making a real bet on these differentiators, and the success of their stock will be an important litmus test for these strategies in the broader market.

Ten Key Takeaways

1. The primary care market is being pushed forward by tech-enabled, patient-centric providers

Oak Street Health isn’t even the first primary care provider to IPO this year - that honor goes to One Medical, which went public in January with a similar vision (although they are more niche).

These practices differ from traditional ones in really focusing on the customer experience (often taking cues from the hospitality industry) as a first-class goal, and leveraging proprietary technology and data to support integrated care delivery models.

I’ve personally used One Medical and have loved their experience, especially the simplicity of their telemedicine app and the transparency around payment. To be honest, I’ve never cared much about an employer’s affiliated provider network when choosing jobs in the past, but in the future this will be a real factor for me because the experience is just that much better (disclosure: I’m long One Medical).

2. Most of their revenue is from capitation agreements

Capitation is a type of a health care payment system in which a provider is paid a fixed amount per patient annually. This allows providers to share in the financial risk of taking care of the patient holistically; if that patient costs less than the capitation amount, the providers get to pocket the difference — but if the patient ends up costing more, the providers are on the hook financially.

The incentives of a capitation-based model are very different from the traditional fee-for-service (FFS) model that has dominated American healthcare until very recently. Generally speaking though, capitation-based models incentivize more preventative and primary care as opposed to acute emergency care in the FFS system, which tends to be a lot more expensive for everyone involved. In my opinion, the move towards more capitation-based agreements is a good thing for American healthcare.

Significantly, a full 65% of Oak Street’s patients are covered by capitation-based agreements, and they make up a stunning 99% of Oak Street’s revenue! Oak Street is staking a significant amount of its future success on the premise that it can take good clinical care of these patients through preventative medicine to reduce long-term costs. Only time will tell if they are successful (and I hope they are)!

3. Medicare Advantage is a great customer for companies that actually want to pursue “value-based healthcare”

Most of Oak Street’s customers are payors that offer Medicare Advantage plans, with a large majority of contracts being with Humana (more on that later). This makes sense strategically, because first of all Medicare Advantage is a growing program - look at the growth in the number of enrollees in the last decade!

Second, being a healthcare provider for a Medicare Advantage plan also has the advantage (heh) in that these plans have a capitation-based payment model, which fits right into Oak Street’s strategy mentioned in the previous point. Medicare Advantage seems to be the hot market right now for companies that are trying to shift towards more value-based payment models, and I’m excited to see how it all shakes out in the next 5 years.

4. Interdisciplinary care teams are critical to their strategy

It is also encouraging to see Oak Street investing heavily into the idea of interdisciplinary care teams that have autonomy of clinical practice:

Our Care Teams are cohesive, modular team units of primary care providers responsible for driving improved patient outcomes by leveraging the Oak Street Platform. The average Oak Street center has capacity for six Care Teams and each team can generally serve up to 600 patients, compared to between 1,200 and 1,900 patients that the average primary care physician serves.

Furthermore:

Our patients experience the results of this differentiated approach through approximately eight physician visits per year, significantly more visits than a patient can expect with a typical primary care physician, with our sickest patients being seen even more frequently. In addition, we manage the total number of patients assigned to a Care Team at each center to allow each Care Team to spend more time with their patients and reduce wait times. Our physicians typically complete visits for approximately 10 patients per day, compared to approximately 19 patients per day for the average primary care physician. This results in patient visits that are significantly longer than the average length of a typical primary care visit. This investment is justified by the health profile of the population we serve and pays off through reduced downstream spending on expensive acute episodes and other unnecessary utilization.

It will be interesting to see if they can maintain this differentiator as they continue to scale, but I think their patient-to-care team ratios and longer appointment times will be a strong incentive to help them win in an increasingly consumeristic healthcare market.

5. It’s easier to bootstrap your “technology platform” on top of a pre-existing EMR (Greenway)

Here’s an interesting section of the S-1 from a product perspective:

Canopy: Our Purpose-Built, End-to-End Technology

Canopy is a key driver of the success of our care model and underlies every aspect of our day-to-day patient engagement and workflows. Canopy comprises internally developed software that connects a suite of population health analytics and technology applications designed to fit seamlessly into our care delivery model and Care Team virtual and in-person workflows.

While it feels mandatory these days for every healthcare IPO to include a section about proprietary technology being a key differentiator, it is interesting to note that their platform was not actually built from the ground up, as mentioned in Note 7:

Canopy is an application that was created by the Company’s internal Information Technology team in 2017 to provide support for Greenway, its electronic medical records (“EMR”) software. The Company’s EMR collects and contains general information such as treatment and medical history about its patients. The Canopy application is used to help fill Greenway gaps and make way for innovative healthcare tools.

The tl;dr is that I expect that most of “proprietary end-to-end technologies” that make up this new tranche of healthcare IPOs still rely on a third-party EMR as the foundation, since it’s just not that easy to build one up from scratch. It’s also a good lesson for product managers that if you’re trying to build a multi-billion dollar company in this space, it’s probably better to buy-and-modify than build-from-scratch.

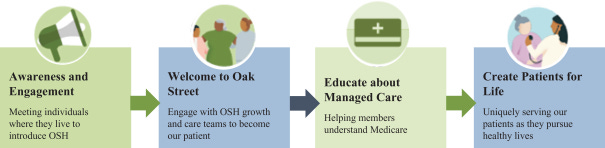

6. Investing in a boots-on-the-ground approach for building brand awareness and engagement

It’s refreshing to see that Oak Street is actually taking an old-school, community-centered approach to getting patients signed up for their clinics, and I believe that this will be one of their main differentiators over competitors.

One of my hypotheses is that part of the reason Americans are so dissatisfied with healthcare in general is that the businesses have gotten so large and consolidated that the key human contact element has been lost. For example, hospitals spent $8 billion in advertising spending in 2018, but the commercials always felt insipid and impersonal to me.

I sincerely hope that Oak Street’s on-the-ground recruitment approach — while potentially more expensive upfront — will result in more engaged, healthier, and loyal patients that will help both the business and the surrounding community in the long-run.

7. Their NPS is impressively high, especially for healthcare

Something else that caught my eye from the S-1:

We have highly satisfied and loyal patients, as evidenced by our Net Promoter Score of 90.

90! I hope that’s true - a Net Promoter Score (NPS) of 90 is world-class in any industry, especially in healthcare. However, it would be great to know how they calculated that and what their sample size was. In any case, it’s a better reported NPS than Costco - and I truly love Costco!

8. It helps to have a close partnership with a large payor…for now

Oak Street has a very close relationship with Humana, with over 49% of their capitation-based revenues coming from this single source. In addition, they mention that they have a significant number of their clinical centers actually “leased from Humana.” Finally, Humana owns more than 5% of the outstanding shares in Oak Street, and has multiple members on the Board.

While I’m sure this arrangement has been beneficial in bootstrapping Oak Street’s initial growth, it will be interesting to see what happens as they mature when they want to expand to non-Humana controlled territories, or work with other payors that are competitive to Humana. And it does feel like Oak Street is putting a lot of eggs in a single basket here…

9. So far investors are lovin’ it

Oak Street’s current price is more than 2x its initial IPO expectation range of $19-20 per share — talk about optimism!

10. But what about the unit economics in the long-run?

Here’s what makes me nervous though:

Oak Street currently has a market capitalization of $11 billion on a total net loss of $109 million in 2019.

One Medical currently has a market capitalization of $3.7 billion on a total net loss of $45 million in 2018.

The stated goal of both companies right now is to focus on top-line growth, not profitability, but it remains to be seen if they can make the unit economics work out. While I am hopeful that they can scale their business models, I am also wary of the last cohort of tech-enabled IPOs with high market capitalizations based off “game-changing technology” in traditional industries (I’m looking at you Uber and Lyft) — but that still haven’t been able to make the unit economics work out to date. And the resultant picture is sad:

Why Oak Street Matters

I really do want to believe in Oak Street - I think their focus on value-based capitation business models is a positive paradigm shift from the current fee-for-service one, and I hope to see more of it in the next generation of care delivery companies. The current fee-for-service model does not reward preventative care, which really should be at the foundation of all healthcare, and is the only way to dramatically reduce the cost of care in the long run.

And I do hope that they are able to leverage a multi-disciplinary care model coupled with state-of-the art technology to make data-driven and effective decisions that will ultimately improve care as well. The important thing for me though is that they are first and foremost in the practice of actually delivering care, and that technology is not seen as an end in-and-of-itself, but rather as a useful tool to support that mission.

Finally, I am optimistic that their IPO, along with the string of other digital health IPOs slated this year means that the dream of value-based, tech-empowered healthcare is finally here. At the same time, I’ve been through a few hype cycles now, and it’s hard to know if this will end up being a blip, or really the beginning of a sea change. Here’s to hoping it’s the latter.

What do you think? Leave a comment, or subscribe if you’d like more content like this in the future!

Addendum: Why Read S-1s

I’ve found reading S-1s to be one of the best ways to expand my thinking and learning about business. Yes, they’re typically over 100 pages and are filled with all sorts of arcane details and legalese, but can be really revealing if you know where to look.

I typically like to go to the Table of Contents and open the following sections in new tabs, and then do a deep read in the following order:

Prospectus Summary: First, I like to understand the vision that the company has for itself (including the crazy ones, like WeWork’s original S-1)

Consolidated Financial Statements: Next, I like to look at the Balance Sheet, Income, and Cash Flow statements to understand the fundamentals of the company’s business - are they making money, how much is in the bank, etc.

Management’s Discussion and Analysis: This is where there’s typically a lot of meaty commentary from the executives themselves on how they think about their business - worth a read for sure.

Risk Factors: Finally, I like to read through the risk factors to understand some of the operating dynamics of the company’s market, and think about how they relate to the businesses that I operate in.

How do you read S-1s?